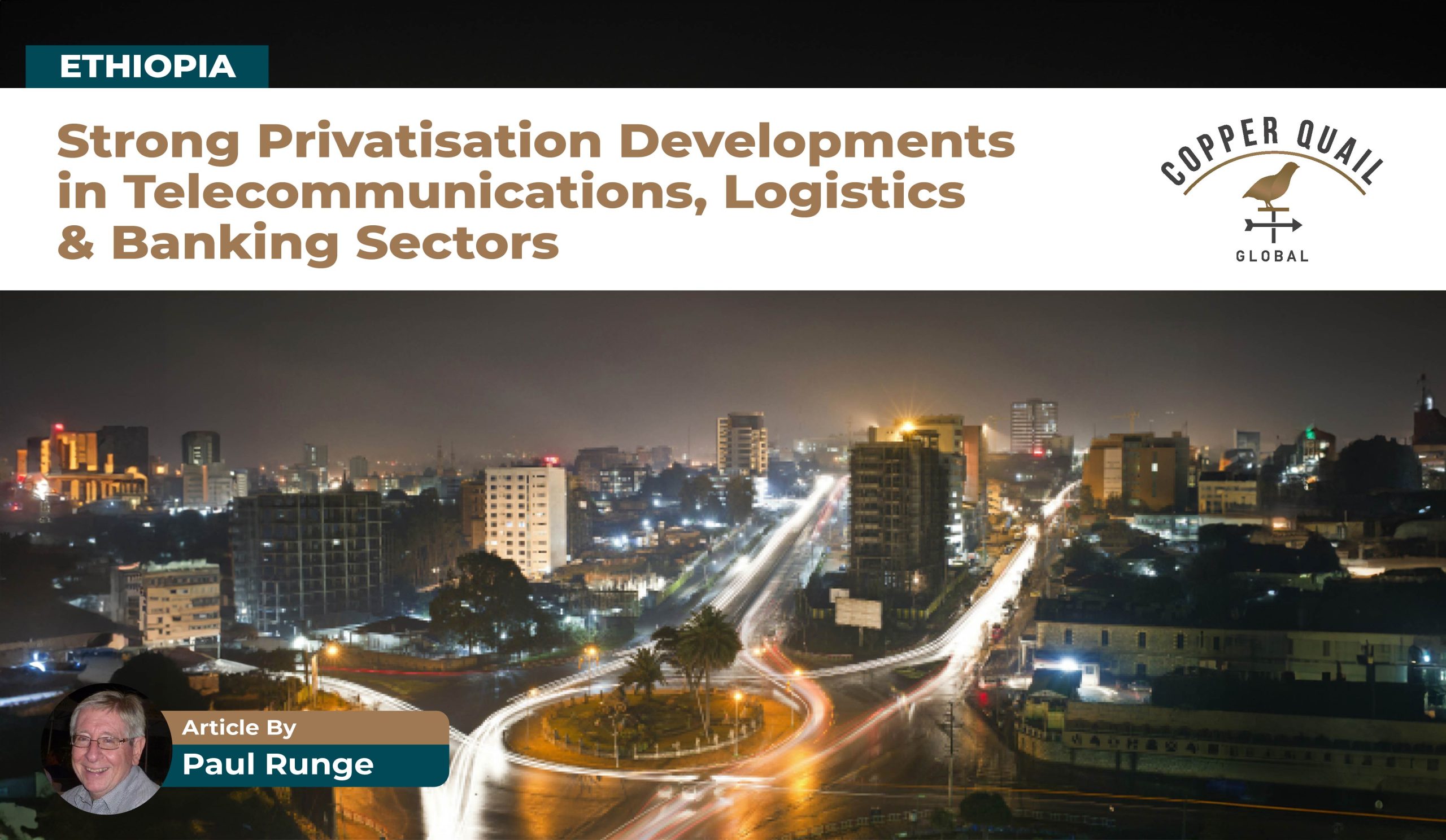

ETHIOPIA: STRONG PRIVATISATION DEVELOPMENTS IN TELECOMMUNICATIONS, LOGISTICS & BANKING SECTORS

GOVERNMENT MAKING LONG-AWAITED PRIVATISATION MOVES

When I led a large business mission to Addis Ababa in 2016, it was impressed on me by the government authorities whom I met then that state controls and monopolies, and limitations on foreign company involvement were prevalent. One state shipping company representative told me that exporters and importers must use local logistics service providers and that “There are very strict rules in this regard.”

But things have changed in Ethiopia …

Foreign investors have long awaited concrete steps by the Ethiopian government to loosen up state monopolies and allow privatisation. As sub-Saharan Africa’s second most populous country at over 120 million and recently one of the world’s fastest growing economies, the opportunities from privatisation will bring huge opportunities.

MAJOR INVESTMENT EVENT: LICENSE TO SAFARICOM M-PESA

There has long been substantial investor interest in Ethiopia’s mobile telecommunications sector. The country was one of the last in the world to maintain a state monopoly of the sector. The very recent granting of a money service license to Kenya’s Safaricom M-Pesa marks a major ending of state monopoly of the mobile communications sector. Ethio-Telecom has until recently been viewed by previous governments as a state revenue-generating ‘treasure trove’ not to be ‘given away’. Ethio-Telecom also has a mobile money service, Telebirr. Now there have been pronouncements of a desire to sell up to 45% of the state telecommunications utility. The national Digital Ethiopia 2025 programme is propelling the changes.

Since Safaricom Ethiopia began utilising its general mobile telecommunications license in October 2022, the company has been registering considerable success. In its first month of operation, it registered revenue of about US $ 718 million and it now claims to already have over one million customers. (The Safaricom Telecommunications Ethiopia – STE consortium comprises Vodafone of the UK, Vodacom of South Africa, British International Investment and the Sumitomo Corporation of Japan.)

This is clear evidence that foreign investors were correct in their estimations of the profitability of the Ethiopian telecommunications sector.

AND IT LOOKS AS IF THE TRANSPORT LOGISTICS SECTOR IS BEING FREED UP TOO …

The Ethiopian Maritime Affairs Authority is finalising a new directive for the licensing of private multimodal transport operators. The monopoly has been held by the state-owned Ethiopian Shipping and Logistics Services Enterprise and as stated above, exporters and importers have been obliged to use accredited local logistics service providers.

Two major French logistics groups have very recently entered the Ethiopian logistics market by engaging in partnerships with local companies. Bolloré Africa Logistics has concluded an agreement with CLS Logistics and the CMA/CGM Group has signed with MACCFA Freight Logistics.

Ethiopia is well integrated into the East African regional economy and is a prominent member of the Community Market for Eastern and Southern Africa (COMESA). Liberalisation of the trade services sectors will enhance its regional economic integration and bolster its trade in the region and beyond.

AND THE BANKING SECTOR TOO …

The governor of the central bank has just announced that 3-5 banking licenses will be granted to foreign investors over the next five years. (Investors are nevertheless encouraged to collaborate with local companies.) The government intends attracting foreign investments by liberalising the financial services sectors. New draft banking legislation indicates that foreign lenders will be able to take participation in Ethiopian banks of up to 30%.

It is reported that Standard Bank is among those giving serious consideration to entering the Ethiopian banking sector. Foreign banks have for long been keeping a watching eye on these developments by for example appointing in-market informal representatives.

HOWEVER, DO NOT EXPECT LIBERALISATION TO MOVE TOO FAST.

The conflicts in Ethiopia have slowed the liberalisation processes. The national economy has also slowed with the International Monetary Fund now predicting GDP growth of 3,8% compared with the over 6% growth registered in the pre-conflict years. The government is embarking on the liberalisation path to give impetus to the restoration of high economic growth but there are still substantial formalities that foreign investors must complete in order to place themselves in the running for these privatisation opportunities.

Each of the sectors dealt with above have state regulatory authorities. In the case of communications, it is the Ethiopian Communications Authority; for transport logistics, it is the Ministry of Transport and Logistics and agencies such as the Ethiopian Maritime Affairs Authority; and banking licenses require approval from the National Bank of Ethiopia.

As elsewhere in the sub-continent, the drive for localisation and local beneficiation is strong in Ethiopia and meaningful local partnerships are strongly recommended.

The wheels of bureaucracy may turn slowly in Ethiopia but my general impression gained after numerous visits to the country is that of numerous particularly competent officials in many government agencies.